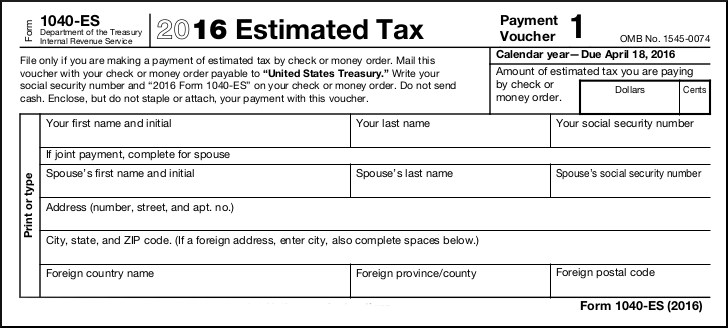

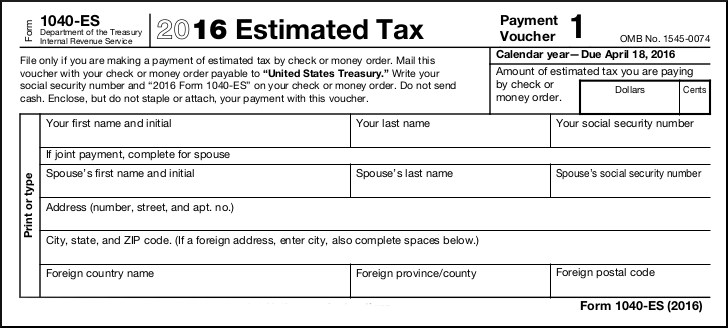

If you’re self-employed, your first estimated tax payment of the year is due April 18. Maybe you’ve brushed this small detail of your work life aside, in hopes that you can just settle up once a year, but you run the risk of a penalty if you avoid sending Uncle Sam quarterly payments. If you’re not sure where to start, accountant Steven Zelin, whose clients include over 200 creatives and professionals like yourself, suggests starting with the amount of money you made last year to help calculate your total tax owed every three months. He can help you prepare your payments for this year and last—just get in touch.